Stonewell Bookkeeping for Dummies

Little Known Facts About Stonewell Bookkeeping.

Table of ContentsSome Known Incorrect Statements About Stonewell Bookkeeping Unknown Facts About Stonewell BookkeepingWhat Does Stonewell Bookkeeping Do?Not known Facts About Stonewell BookkeepingThe Ultimate Guide To Stonewell Bookkeeping

Rather than experiencing a filing closet of different records, invoices, and receipts, you can offer thorough documents to your accountant. Subsequently, you and your accountant can save time. As an included incentive, you may even have the ability to identify possible tax write-offs. After using your accountancy to submit your taxes, the IRS might pick to perform an audit.

That funding can can be found in the type of owner's equity, grants, service car loans, and investors. However, financiers need to have a good concept of your organization prior to spending. If you don't have accountancy documents, capitalists can not establish the success or failing of your firm. They need updated, exact details. And, that details requires to be conveniently accessible.

What Does Stonewell Bookkeeping Do?

This is not planned as lawful guidance; for more details, please go here..

We addressed, "well, in order to know just how much you need to be paying, we require to recognize exactly how much you're making. What are your revenues like? What is your take-home pay? Are you in any kind of financial obligation?" There was a long time out. "Well, I have $179,000 in my account, so I presume my web income (earnings much less expenses) is $18K".

Not known Facts About Stonewell Bookkeeping

While maybe that they have $18K in the account (and also that might not hold true), your balance in the financial institution does not necessarily identify your earnings. If a person received a grant or a funding, those funds are ruled out profits. And they would certainly not infiltrate your income declaration in establishing your profits.

Several things that you think are costs and deductions are in truth neither. Accounting is the process of recording, categorizing, and organizing a business's monetary purchases and tax obligation filings.

An effective business requires help from specialists. With sensible objectives and a skilled accountant, you can quickly attend to difficulties and maintain those concerns away. We're here to assist. Leichter Accounting Services is a skilled certified public accountant company with an enthusiasm for accountancy and devotion to our customers - business tax filing services (https://www.easel.ly/browserEasel/14618404). We dedicate our energy to ensuring you have a strong financial structure for development.

Some Known Facts About Stonewell Bookkeeping.

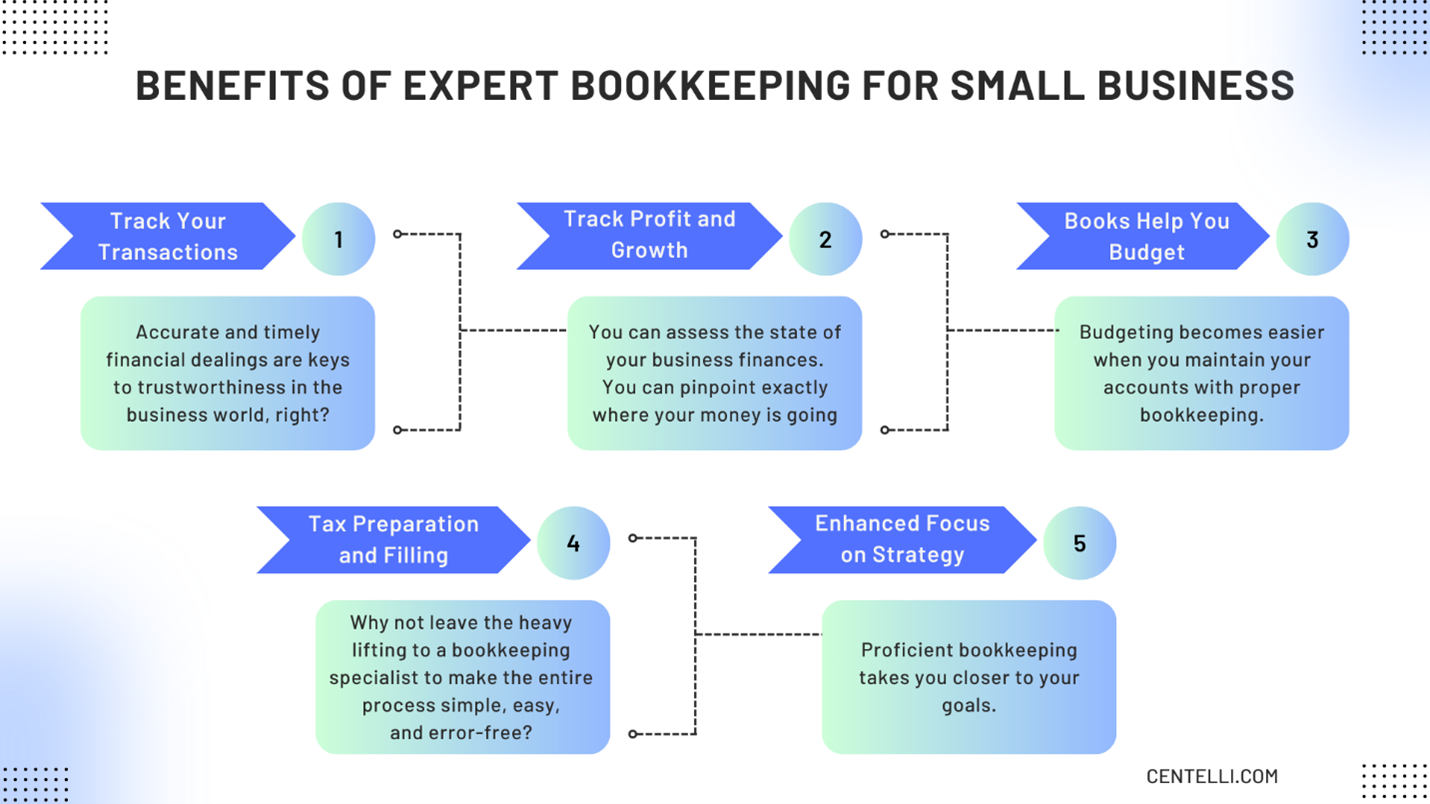

Accurate bookkeeping is the foundation of excellent financial management in any business. It helps track revenue and expenditures, making sure every transaction is recorded effectively. With great bookkeeping, companies can make better choices due to the fact that clear economic documents use important data that can lead strategy and improve earnings. This details is essential for long-term preparation and projecting.

Meanwhile, solid accounting makes it less complicated to protect financing. Accurate financial statements construct depend on with lenders and investors, raising your possibilities of obtaining the capital you require to expand. To preserve solid financial wellness, businesses must consistently resolve their accounts. This indicates coordinating purchases with financial institution statements to capture mistakes and prevent financial discrepancies.

A bookkeeper will go across financial institution statements with internal records at least when a month to find errors or incongruities. Called financial institution reconciliation, this process assures that the financial documents of the company suit those of the bank.

They keep track of present payroll information, subtract tax obligations, and number pay ranges. Accountants produce basic financial reports, including: Earnings and Loss Declarations Shows profits, expenditures, and web profit. Balance Sheets Lists possessions, responsibilities, and equity. Cash Flow Declarations Tracks money movement in and out of the company (https://www.easel.ly/browserEasel/14618404). These reports assist company owner recognize their financial position and make notified choices.

Not known Factual Statements About Stonewell Bookkeeping

While this is economical, it can be lengthy and prone to errors. Tools like copyright, Xero, and FreshBooks permit company proprietors to automate accounting tasks. These programs aid with invoicing, bank settlement, and financial coverage.